So I put some money in an ETF today. This isn’t the first time I invested in one. A long time back, before my then employer had bought and essentially killed Benchmark, I had invested in a couple of their ETFs – the Nifty ETF to get invest in the broad Indian market, and GoldBees to hedge against increase in the price of gold as I was planning my wedding.

I had some Rupees lying around in my bank account for a long time, and given that the Indian markets have tanked, I thought this is a good time to get invested. In fact, this isn’t the first time in recent times I’m having such a thought – about a month back I had put in more money into the Indian markets, but had then chosen a low cost index tracking mutual fund (and I’m not tracking how my investment is doing).

Anyway, today I decided to invest in ETFs since the transaction costs (in terms of both trading, and annual expenses) are much lower. A quick chat with a friend currently trading the Indian markets revealed that the SBI Nifty ETF is the best option to go with, and I was left with the small matter of just making the investment.

I’m generally happy with ICICI Direct as my broker, since in general the interface and app are pretty nice. Last month, the purchase of the mutual fund through the same app had been pretty simple. And I imagined buying the ETF will be easy as well. It wasn’t. And if I, as a professional investor with considerable capital markets experience, find it hard to invest in ETFs, I can only imagine how hard it might be for mango people to invest in them.

So the points of pain, in order, that prevent people from investing in ETFs:

- Knowing that indexing exists. Most people seem to think that the only ways to invest are by researching the stocks themselves, or by paying an asset manager fairly hefty fees.

- Once you know you can index, the fact that you can do it through an ETF. ETFs are again not well known, and not really marketed broadly since their fees are low (with Benchmark’s demise, we don’t really have ETF-first fund houses in India, like we have Vanguard in the US).

- Related, even some of the more popular robo advisory funds in India largely use mutual funds, rather than ETFs.

- Once you know you can index, and do so through an ETF, the next task is to find out which ETF you should invest in. Literature exists, but is not easy to find. My friend sent me this page, and asked me to select the fund with highest market size. Knowing that I want to invest in the broad market, and in large caps, the choice of SBI Nifty ETF was easy for me.

- But it’s not so intuitive for a less sophisticated investor. For example, correlating asset size with liquidity isn’t exactly intuitive.

- Different ETFs track different indices, and knowing which one to invest in is again not a trivial task.

- Having selected an ETF to invest in, you go to your broker’s site or app (I used the app). And you need to know that ETFs are clubbed with equities, and not with mutual funds (not an intuitive classification for most people)

- So I go to ICICI Direct’s Equities page, allocate funds to it (from my bank account, also with ICICI), and hit “buy”. There’s a text box where I need to enter what I’m looking for, and then there’s a dropdown that pops up.

I type “SBI”, and the first thing it shows is the SBI Bank Nifty tracker. This is followed by lots of bonds. I don’t know if it’s clever nudging on ICICI’s part to get you to invest in the Bank Nifty, since that has a significant exposure to ICICI, or if it’s something as mundane as alphabetical sorting. The latter is more likely.

- Scrolling down the list past all the bonds, it’s not easy to know which is the SBI Nifty ETF. Because there’s a “SBI Nifty Next 50 ETF” (smaller caps, so more volatile, not something I want), and a few others with confusing names.

- Then you need to enter the number of units you need to purchase. This is unlike in mutual funds where you just enter the amount you want to invest. Here I had to pull up a calculator to know exactly how many units I had to buy.

- I hit “market order”, and then on the next screen I got a warning that since this wasn’t a particularly liquid instrument I was only allowed to post limit orders. So I had to guess what was a reasonable spread I was willing to pay, and put that. Thankfully the ETF was fairly liquid, and I got execution close to mid.

Honestly, I felt rather daunted at the end of the exercise, and I’m what most people would classify as a sophisticated investor. So there is no wonder that more people aren’t investing in ETFs.

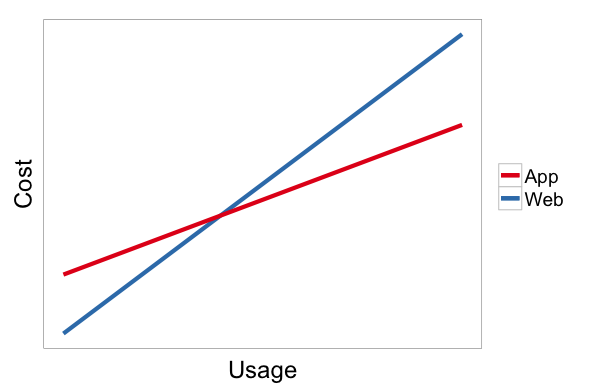

The advantage of ETFs is extremely low fees (the fund I purchased today charges 7 basis points a year), and one downside of it is that it doesn’t allow for more marketing budget.

I’m beginning to think that the way to “solve” this market is by having a bundled ETF and robo advisory offering. Perhaps more on that later.