Whenever there is a massive stock market crash, like the one in 1987, or the crisis in 2008, it is common for investment banking quants to talk about how it was a “1 in zillion years” event. This is on account of their models that typically assume that stock prices are lognormal, and that stock price movement is Markovian (today’s movement is uncorrelated with tomorrow’s).

In fact, a cursory look at recent data shows that what models show to be a one in zillion years event actually happens every few years, or decades. In other words, while quant models do pretty well in the average case, they have thin “tails” – they underestimate the likelihood of extreme events, leading to building up risk in the situation.

When I decided to end my (brief) career as an investment banking quant in 2011, I wanted to take the methods that I’d learnt into other industries. While “data science” might have become a thing in the intervening years, there is still a lot for conventional industry to learn from banking in terms of using maths for management decision-making. And this makes me believe I’m still in business.

And like my former colleagues in investment banking quant, I’m not immune to the fat tail problem as well – replicating solutions from one domain into another can replicate the problems as well.

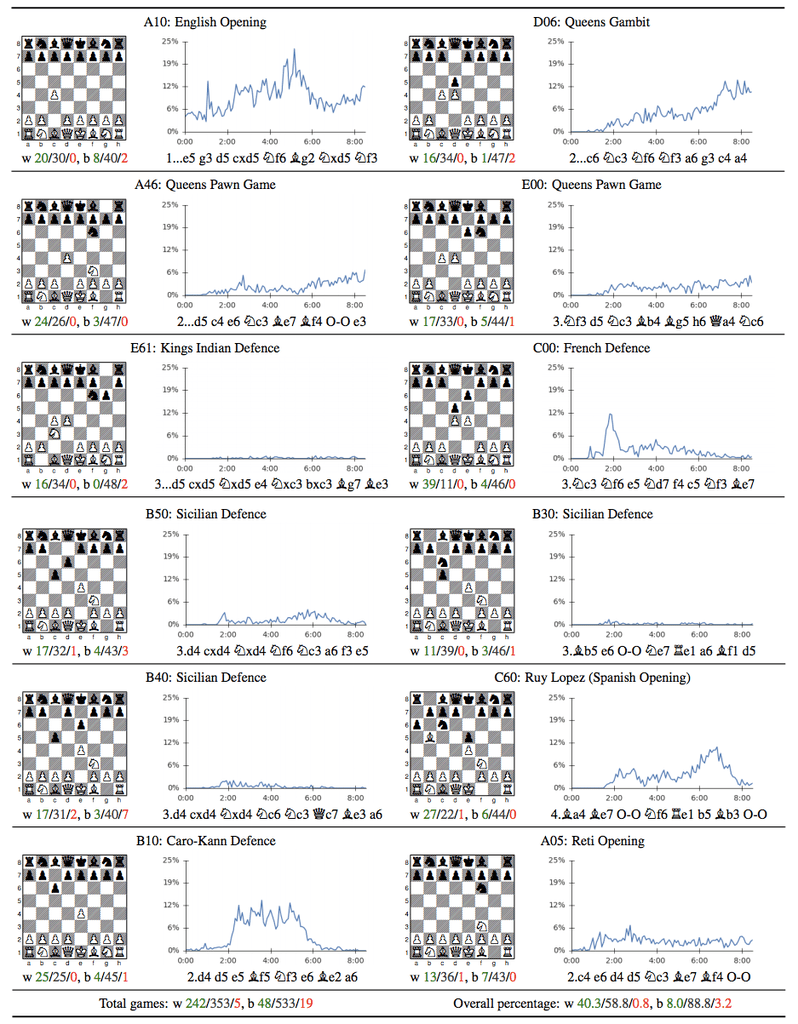

For a while now I’ve been building what I think is a fairly innovative way to represent a cricket match. Basically you look at how the balance of play shifts as the game goes along. So the representation is a line graph that shows where the balance of play was at different points of time in the game.

This way, you have a visualisation that at one shot tells you how the game “flowed”. Consider, for example, last night’s game between Mumbai Indians and Chennai Super Kings. This is what the game looks like in my representation.

What this shows is that Mumbai Indians got a small advantage midway through the innings (after a short blast by Ishan Kishan), which they held through their innings. The game was steady for about 5 overs of the CSK chase, when some tight overs created pressure that resulted in Suresh Raina getting out.

Soon, Ambati Rayudu and MS Dhoni followed him to the pavilion, and MI were in control, with CSK losing 6 wickets in the course of 10 overs. When they lost Mark Wood in the 17th Over, Mumbai Indians were almost surely winners – my system reckoning that 48 to win in 21 balls was near-impossible.

And then Bravo got into the act, putting on 39 in 10 balls with Imran Tahir watching at the other end (including taking 20 off a Mitchell McClenaghan over, and 20 again off a Jasprit Bumrah over at the end of which Bravo got out). And then a one-legged Jadhav came, hobbled for 3 balls and then finished off the game.

Now, while the shape of the curve in the above curve is representative of what happened in the game, I think it went too close to the axes. 48 off 21 with 2 wickets in hand is not easy, but it’s not a 1% probability event (as my graph depicts).

And looking into my model, I realise I’ve made the familiar banker’s mistake – of assuming independence and Markovian property. I calculate the probability of a team winning using a method called “backward induction” (that I’d learnt during my time as an investment banking quant). It’s the same system that the WASP system to evaluate odds (invented by a few Kiwi scientists) uses, and as I’d pointed out in the past, WASP has the thin tails problem as well.

As Seamus Hogan, one of the inventors of WASP, had pointed out in a comment on that post, one way of solving this thin tails issue is to control for the pitch or regime, and I’ve incorporated that as well (using a Bayesian system to “learn” the nature of the pitch as the game goes on). Yet, I see I struggle with fat tails.

I seriously need to find a way to take into account serial correlation into my models!

That said, I must say I’m fairly kicked about the system I’ve built. Do let me know what you think of this!